Dear @financial_laura,

I keep hearing that I should be “diversified”. Is it enough to be diversified internationally, or should I also look at the sectors?

Diversification is one of the most critical considerations when analyzing a portfolio. The old saying: “Don’t put all your eggs in one basket” comes to mind – but these days there are just so many baskets (and often limited eggs!) that it is difficult for investors to not feel completely scrambled (pun intended).

It’s not enough to buy a number of mutual funds or ETFs and hope for the best. Major incidents in a particular sector (think of what 9/11 did for the airline industry) or country (Greece’s debt crisis impact on the EU) can have a significant effect on the returns in your portfolio if there is insufficient diversification.

Compounding the challenges is the natural inclination for a ‘Home Country Bias’. Investopedia defines this as: “when investors tend to focus more on their home markets and the companies that do business within these markets because they are familiar with them.” Investopedia.

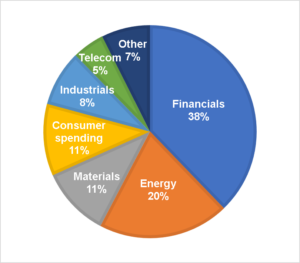

Diversification of the S&P500

If we lived in the U.S., the nature of the Home Country bias would not be as significant, given the size and strength of diversification within the S&P500 by sector.

If we lived in the U.S., the nature of the Home Country bias would not be as significant, given the size and strength of diversification within the S&P500 by sector.

The graph shows the weightings of each sector on the S&P 500 by market cap. While slightly overweight in IT stocks, overall there is a healthy balance. The variety of sectors include: Health Care, Industrials, Financials, and lastly, Consumer staples and Consumer discretionary. I have grouped the Consumer sectors together as the majority are retail businesses or common brands of consumer products.

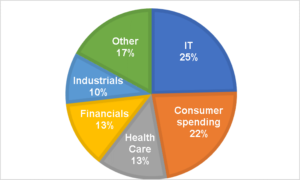

Diversification of the S&P TSX Composite Index

When compared to the S&P 500 the TSX shows its weakness in that it is completely skewed towards Financials and Energy. In addition, there are fewer companies represented (~250) which further reduces the diversification when compared to the S&P500.

The Canadian financial sector proved to be a safe haven through the 2008 financial crisis, and has maintained its stability and high yields over the last decade. It’s no surprise then that investors flock to these stocks and that they dominate the TSX. However it is important to remember that there is always a risk in being overweight in one sector, especially when it is dominated by five main banks. Check your weightings in financials and I bet you’ll be surprised how it dominates your holdings.

What’s a Canadian Investor to do, eh?

Time to take a wholesome view of your portfolio which would include not only your investments, but also your pension, assets (including your house) and all your sources of income. If more than 20% is invested in Canada, or one specific sector, think about reallocating into a more diversified account.

Blackrock has an ETF which is called “iShares Core MSCI All Country World ex Canada Index ETF” (or ticker XAW) and a management expense ratio (MER) of 0.22%. This is an example of one ETF which could cover all your diversification needs. By purchasing this one ETF you have gained immediate exposure to over 8,100 companies in over 15 countries! This is just one simple example of how easy it is to improve your diversification.

Vanguard offers a competing, but slightly more expensive ETF under the ticker VXC and an MER of 0.27%.

Why is Diversification so Important?

After all of this analysis, it’s important to understand that by becoming complacent, or neglectful of your portfolio you are putting your investments at risk. Even if the majority of your money is with one institution or diversified fund, the onus is on you to ensure all of your assets, even your house, are being considered in your portfolio.

If you’re a lover of sports, Pro-Line really says it best: “because anything can happen!”

This article was first published on my blog at www.journeyfinancial.ca