Dear @financial_laura, I don’t have a lot of money to contribute, but I’m behind on my RRSP contributions. Is there an easy way to catch-up?

February is coming and that means not only thinking about a plan for Valentine’s day, but also about the RRSP contribution deadline for 2018.

Like most Canadians, you’re probably also forced to think about RRSPs at some point throughout the year. Maybe you make regular contributions through your defined contribution pension, or automate a regular amount to invest (go you!). Or maybe you wait until 11:45pm on February 28th and freak out because you’ve totally forgotten to make a contribution and have to repay your first-time Home Buyers Plan (well there’s always next year to get organized).

No matter which RRSP personality you have, what if I told you that with very little effort upfront, you could be contributing 40% to 70% more to your RRSP? Sounds crazy, but it’s possible – and totally legal!

You are eligible for this strategy if you answer ‘yes’ to all the following statements:

- You will be making a significant enough RRSP contribution (or have other deductions and credits) that you will receive a tax refund;

- You have enough RRSP contribution room to allow for an increased contribution;

- You use tax software (Turbotax or SimpleTax as examples) and can do multiplication at a Grade 4 level; and

- You pinky-swear that you will not spend your tax refund when you receive it!

RRSP Gross-Up Strategy

This strategy is so effective, I’m always surprised that not many people use it. But I’m sure the main reason is because it involves some dirty finance words: ”borrowing to invest” or (gasp) “DEBT”.

Before you start boo-ing and pelting me with virtual tomatoes, read how simple this process can be and how much can be gained with no risk because you will repay the whole debt before the first payment is due.

Step 1: Open an RRSP Line of Credit

Not to be confused with an RRSP Loan which is a one-time use product, the RRSP Line of credit will remain open to you year-round (even though you will use it for less than 30 days) and once it’s set up will require no additional work each year. Most of the major banks offer this product including Scotia’s RRSP Catch-Up Line of Credit and BMO RRSP Readiline. The documentation that is required for this is simply proof of your existing RRSP account (it can be at any institution).

Step 2: Expected Tax Refund

Complete your taxes using your tax software before the last week of February. This will mean gathering all your tax forms and inputting everything. The timing is critical because you will want to borrow the RRSP amount prior to the RRSP deadline which is usually the last day of February (or first day of March). You do not necessarily have to file your taxes at this point, but the key is to know the exact amount of the tax refund.

Step 3: Marginal Tax Rate

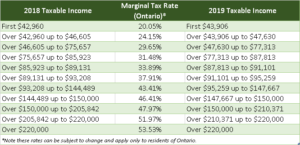

Go to simpletax.ca/calculator and enter a few of the fields from your taxes and it will show you the marginal tax rate. The definition of a marginal tax rate is the tax paid on the next dollar of income (within a prescribed band – see chart below).

Here is a basic table of the tax rates (combined federal and provincial) for 2018/2019 in Ontario to see if you’re on the right path:

Step 4: The Formula

Perform the following calculation…

Expected Tax Refund / (1-Marginal Tax Rate) = Gross-Up amount to borrow

Step 5: Borrow the Gross-Up Amount

Login online to your RRSP Line of Credit and borrow the amount you calculated in Step 4. To pay the least amount of interest, complete this transaction as close to the RRSP deadline as possible.

Step 6: File your taxes

Ideally you would file your taxes immediately, and include the gross-up amount as an RRSP contribution from the period of January to February. When you enter this amount into your taxes, the refund amount should now equal the amount borrowed in Step 5.

Step 7: Repay the Loan

This is where you twiddle your thumbs and wait for the tax refund to arrive. When it does, you then repay the full balance of the RRSP line of credit. You will have a small amount of interest to pay depending on the interest rate and the number of days the line of credit had a balance (should be less than $50).

The Results

If you’re still with me you’re probably wondering what this seven-step program gets me, other than a drinking problem.

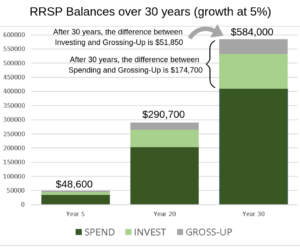

Let’s walk through an example using Susie who earns $80,000 and contributes $6,000 to her RRSP (or $500 per month) throughout the year. Assuming no other deductions, her refund will be $1,800 from her RRSP contributions alone.

Scenario 1 – SPEND:

Susie spends her refund on a new fridge. At the end of the year she has grown her RRSP by $6,000 and has a new fridge.

Scenario 2 – INVEST

Susie receives her $1,800 refund and reinvests it into her RRSP. Now at the end of the year her RRSP has grown by $7,800. Not too shabby – 30% more than spending it.

Scenario 3 – GROSS-UP:

Susie walks through the steps for the RRSP Gross-Up. She’s in the 29.65% marginal tax bracket (because her RRSP contributions reduced her taxable income) which means:

Expected Tax Refund / (1-Marginal Tax Rate) = Gross-Up

1,800 / (1-0.2965) = $2,560

Susie borrows this amount from her RRSP line of credit and invests it. Her RRSP Line of Credit Balance will be $2,560 which is also the refund she will receive for RRSP contributions of $8,560. Now her RRSP balance at the end of the year is $8,560. That’s 43% MORE than spending the full refund.

Here is a summary of the three strategies over the long-term assuming Susie’s income never changes (unlikely, but this is for illustration purposes so work with me here):

The Risks

When borrowing money there is always the risk of turning good debt into bad debt which doesn’t get repaid. Diligence around timing and repayment are key to ensuring this strategy is the most effective and has minimal impact on your cash flow. An interest payment will also be required and the longer it takes to repay the balance, the larger the interest will be.

You Can Do It!

If you are behind on RRSP contributions and this Gross-Up strategy sounds like something you need, but are too intimated to try it on your own, seek the guidance of a Financial Consultant (wink,wink) or your Financial Advisor or Tax Accountant. Once you walk through it once and see the benefits, you will be confident to try it every year!

Additional Reading

This strategy was popularized by Talbot Stevens in his book: “The Smart Debt Coach”. Check out his website for an RRSP Gross-Up Calculator and additional resources.

Have you used this or another strategy to catch up on your RRSPs? Let me know in the comments below!