Dear @financial_laura,

Our credit card is just not ‘optimal’ anymore. We’re overwhelmed by all the options, so can you tell us which one is right for us??

UPDATE September 2018: MBNA recently announced major decreases in reward benefits and increases in fees for their card. In addition, Rogers launched a new cash back credit card. As a result, here is an updated version of this post to reflect these changes.

Do you ever get that nagging feeling that some part of your financial life is just not optimal? How often do you say, “It’s just an extra $20 a month, no biggie”. But those $20 a month items can really add up!

In this scenario the Jones’ have a credit card with PC Financial but are wondering if there is a better offer with another bank. But they are worried that changing cards will be a hassle because of the pre-authorized bills that will need updating. For this reason alone, many people procrastinate on making a move.

The final push for the Jones’ was the botched merger of the PC points with the Shopper’s Optimum and the creation of the whole new PC Optimum points system. You can read more about it in this great Toronto Star article by Ellen Roseman. Their household was one of the ones affected and despite three calls to PC, one live chat, and one hour spent with a clueless customer service rep in a Loblaws kiosk, their account is still a mess.

Now I’m not saying the PC Optimum cards have no value. If you are a regular Loblaws (and affiliated companies) shopper then there are great benefits to be had with a minimum of 1% back in points on all spending and further points to be earned with promoted products.

However, the Jones’ were finally persuaded to change because of these weaknesses:

- Walmart has begun offering free Click and Collect for groceries compared to Loblaws $3-$5 per pick-up;

- In general, the highest frequency products (produce, dairy, meat) are more expensive at Loblaws; and

- The hassle of remembering to log into the app or website to “accept your offers” each week is pretty annoying.

Never one to settle for qualitative analysis it became time for…a spreadsheet! Hooray!

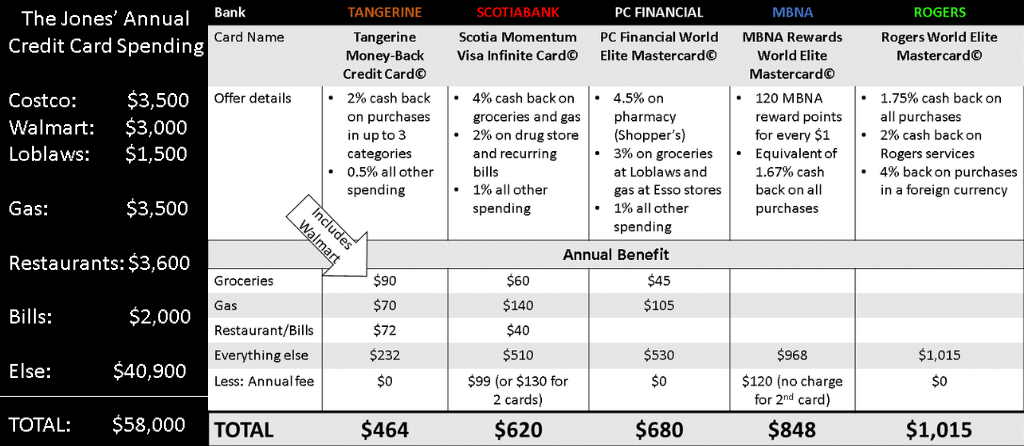

To create this spreadsheet I relied heavily on the Jones’ mint.com budget which enabled me to really break down their spending habits for the last year. I also limited my credit card comparison to ones that offered cash back. Travel reward cards are excluded because I am nervous about the upcoming changes to the Aeroplan program in 2019, and also Air Miles has been prone to devaluing its points (CBC. Jan 2017). Cash is king!

Most credit cards offer at least 1% rewards, or cash back, on all purchases with bonuses for specific categories of shopping, like groceries, gas or recurring bills. Your own spending habits may lead you to prefer a different card, but here is the Jones’ family data and the resulting annual benefit for each card:

As you can see the new Rogers Mastercard is the winner, especially with no annual fee! However, as with all good things in life…there are a few asterisks.

Lessons Learned

There are a few fine-print details that are worth mentioning for those looking to complete a similar comparison.

- Flexibility in cash redemption. Personally, this is a big one – I want to redeem my cash where I want and when I want. Most credit cards affiliated with a ‘store’ want you to redeem cash for purchases at that company (naturally). This is the case for both Rogers and PC Financial where your cash (or points) can be redeemed at any time against purchases or services (like your cell phone bill). Rogers will allow you to redeem your rewards for a statement credit only once per year in January IF you call and request this by December 1st, otherwise you are out of luck for another year. On the other hand, MBNA will allow you to redeem your cash at any time and in any form (cash or statement credit, even travel credits).

- Merchant Category Codes (MCC) are tricky. Specifically for the category of “groceries” you have to be really careful about which stores are included. You’ll note that Tangerine is the only card that includes Walmart as a grocery store. This can be a huge advantage, especially because they do not break-out household products from grocery. Costco spending is NEVER included in this category as it is labelled a Warehouse, or Wholesaler.

- Annual income restrictions. Apparently to be “elite” you need to be making some coin. The MBNA card and the Rogers card have the strictest requirements at $80,000 annual income for an individual and $150,000 for a household.

- Love to travel? Check the insurance. The quality and variety of insurance add-ons vary significantly from one card to the next. I didn’t go into detail in this blog, but the Scotia Visa has the superior insurance offerings of the five.

The Decision

The Jones’ pulled the trigger and applied for the MBNA Mastercard. These were the winning features:

- Best cash back flexibility given their spending habits

- Mastercard so they can use it at Costco (this was a MUST)

- Ability to carry just one card as there are no restrictions for categories of purchases

- Easy to apply cash directly to credit card balance

Do you have a favourite credit card that I did not mention? I’d love to hear your thoughts!

Hi Laura,

What about the Costco Mastercard? Any concerns with using that ine for cash back?

No concerns at all with a Costco card, nor other ‘store specific’ cards (like Walmart or Canadian Tire). The no-fee cash back options of around 1% are very competitive but it’s the limitations in obtaining the rewards that make these cards less flexible than those in my list (with the exception of PC which also limits redemptions to their stores). If you’re a regular restaurant eater, Costco’s 3% back can be appealing!