“I’m looking to buy a used car, but I don’t know how to figure out how much I can afford?”

In a previous life I suspect I was once a used car saleswoman. Not in the greasy, polyester-wearing, dishonest kind of way that’s often stereotyped – it’s just the thought of buying a new car hits on all my sources of anxiety:

- Spending Money – new cars cost A LOT! The idea of taking on debt to pay for a depreciating asset is akin to washing my windows with $50 bills…there are clearly better ways I could be using my money;

- Clumsiness – guaranteed the first time I drove this new car I would either crash it or at the very least someone would bang the door and scratch it; and

- No spreadsheets – there’s something about the fun of the hunt and excessively documenting it. Scouring Consumer Reports and autoTRADER to find the best deals and then ensuring all the options are considered in a colour-coded spreadsheet, including results of test drives…am I alone in this one?

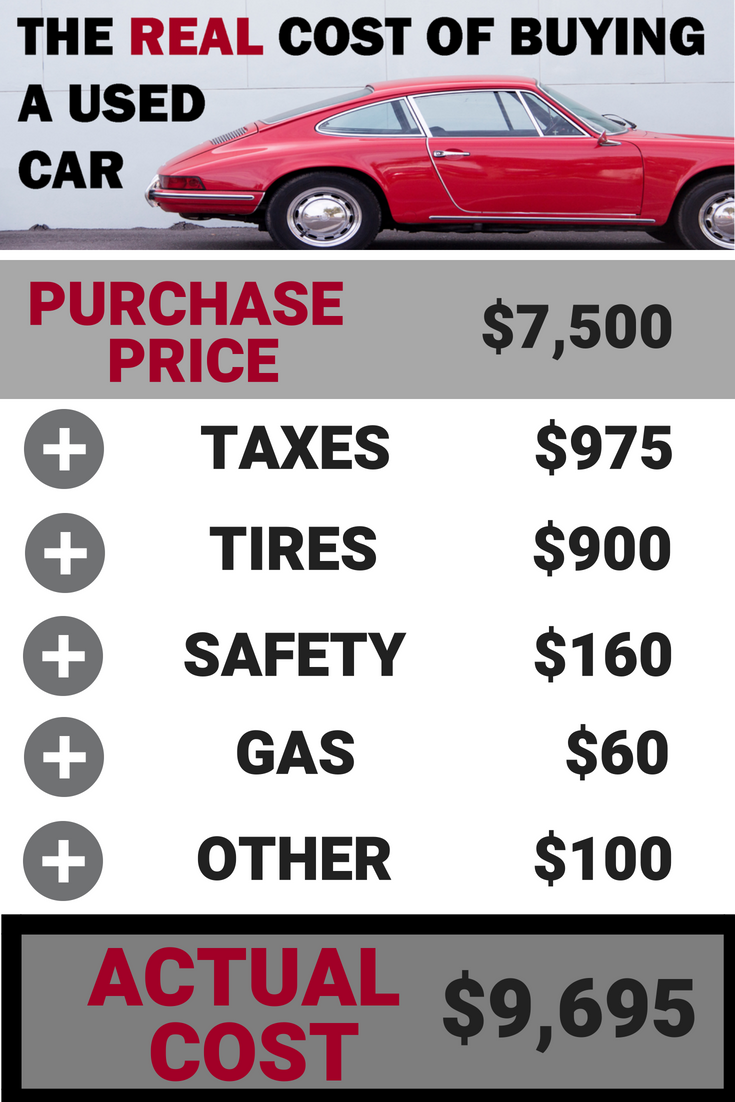

The REAL cost of a used car

No matter what your reason for considering a used or “previously-owned” car, there are definitely costs involved. The heavily negotiated purchase price is not the end of the story. Let’s look at additional costs to consider (noting that many of these may also apply to a new car purchase):

- Safety Inspection by your mechanic (advised when buying a used car): $160

- Taxes: 13% in Ontario

- New tires (a seasonal second set), rims, hubcaps and installation: $900 (approx.)

- Tank of gas (they must siphon the gas because every car seems to perpetually be on empty): $60

- An additional: $100 (this could be taken up with new license plates, car detailing, new car mats, etc.)

The result: in this example if your budget is $10,000 then you should be looking for a car with a purchase price of $7,500. Be sure to consider all the costs when setting your own used car budget!

But wait, there are two other cost considerations…

Insurance

Another major cost consideration in this process is insurance. If you finance a vehicle, you are required to carry full coverage (meaning collision and comprehensive insurance). If you purchase a vehicle outright you have the freedom to choose a level of insurance that meets your risk level. Insure what you can’t afford to lose!

Out of curiosity, I called my insurance broker to compare the costs. The difference between liability insurance (definition: you are on the hook for any damages to your own vehicle) and the full collision and comprehensive insurance was $500 per year, for a policy that includes two drivers and two cars. [Note that this figure would vary for each person depending on many factors, and is for illustration purposes only.]

As a claim-free driver for the last 20 years, I have saved $10,000 by using only liability insurance.

Maintenance

A final point of consideration with used cars is the requirement for maintenance, given there is no warranty. I always budget about $2,000 a year in maintenance (this means setting aside about $160 per month in your Car Account – if you keep separate budget accounts). Most of this money tends to get used later in the car’s life as it approaches that decision point on whether to keep it or send it to that junk yard in the sky. The importance of keeping used cars is longevity – the better you maintain them, the longer they will last and the better value they will be in the long-term.