Is it worth having insurance on my kids?

The debate around insuring children is such a difficult conversation because of the emotions that inevitably surface when talking about the death or injury of a child.

On one hand, from a purely financial perspective, children do not add any income to a household. Quite frankly, they are a liability (sorry kids!). Therefore, there is no reason to hold any life insurance for them. But as others argue, the insurance is not necessarily to replace the child’s non-existent income, but rather the parents’ as they grieve and to possibly to cover the funeral costs.

I see both sides. Personally, we are focusing our financial resources towards an emergency fund and an RESP which could be used in a crisis. This strategy has the advantage of maximum flexibility because we can decide how to allocate the money, rather than having prescribed limits from an insurance policy. However, there are other families that would sleep better at night paying the premiums to ensure that money will not be a primary concern in case of a child’s death.

My kids brought home a pamphlet from school about Student Accident Insurance (insuremykids.com). This was the first time I had seen this type of insurance advertised through the school, so naturally I was curious if there would be additional value. When I watch how fearless my kids are, I feel like the odds of injury are much higher than death.

The Details of Student Accident Insurance

At first blush, the plans seem quite inexpensive where I could insure both kids for one-year with the “Platinum Plan” (the best one) for $66 a year (equivalent to $5.50/month) or $300 for a five-year term ($5/month).

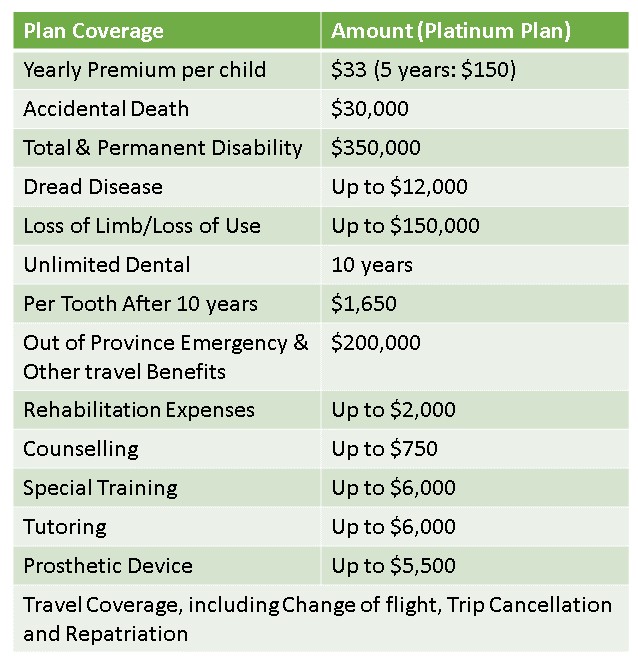

The benefits cover many of the possible costs that could be incurred if your child was in a serious accident. Here is a summary from their website:

Source: Insure My Kids Policy

The Fine Print

As with any contract, read the fine print before signing anything!! In this case, the benefits are straightforward, but the dollar thresholds for reimbursement are quite low.

Examples for the Platinum Plan:

- Dread disease (child diagnosed with serious disease like cancer) – maximum payout $12,000 (coverage up to three years)

- Tutoring – up to $6,000

- Rehabilitation (e.g. physiotherapy) – up to $2,000

- But! Maximum $50 per visit, up to $500 per provider.

- Interestingly, if you lose one finger or toe, the compensation is $150. Lose half a finger above the knuckle and receive $450…so half a finger is worth more than a whole?

Important Limitations

- The benefits paid are only in excess of any benefits received through other sources, like OHIP or an employer Group Plan.

- Payouts for a specific accident are payable under one policy only – though the payouts may be paid over a number of years. This means you cannot access new limits for physio or tutoring if you renew the policy for another year.

- The definition of Totally and Permanently Disabled = cannot ever be employed. This is the most generous benefit ($350,000) however, I would imagine this would be a very difficult definition to meet and the payout occurs one year after the accident.

So what’s a parent to do?

Overall, the benefits are comprehensive, but will likely not cover the complete cost of any of the treatment required. This policy is a good start primarily for families that do not have any Group Benefits through an employer.

Most surprising to me is that I could find no example of anyone’s experience making a claim under this insurance. This could mean one of two things:

- Those who make claims are completely satisfied and are more focused on the accident recovery process then providing reviews of their insurance provider; or

- Not many people make a claim at all. I would like to think that the combination of a family having this type of insurance AND having a child incur a serious injury is extremely rare.

Taking all of it into consideration, I tend to lean towards the wise words of Mr. Sharma below:

“If you really want to protect your children, make sure that you and your spouse are properly insured for disability (income replacement insurance), morbidity (medical expense reimbursement, critical illness insurance) and mortality (life insurance).” – Promod Sharma, Actuary (Source: https://www.milliondollarjourney.com/the-pros-and-cons-of-insuring-your-children.htm)

The Recoskie Family formula:

Insurance (for the adults!) + RESP + Emergency Fund of 3 months worth of expenses = Peace of Mind

Hello, in the 70’s and 80’s my parents took out that insurance (or at least a very similar one) and never claimed against it for my sister or me. However, my Mom said she was very glad to have kept it up because my younger brother triggered it several times – once with a very serious knee injury and it really helped with the physiotherapy costs. I know this because in the 90’s my kids came home with similar pamphlets and I was trying to decide whether to take it or not. In the end, I decided not to, we just covered our kids’ expenses in a similar way to your plan.